A Chain's Weakest Link

Most people are familiar with the saying “a chain is only as strong as its weakest link”. Like most sayings it is popular because of the innate truth to which it speaks. In the commercial world of Pharmacy it could be applied to the “supply chain”, “Pharmacy chains” (ie brands, groups etc) and the community pharmacy network in general.

A recent article in Issue 2229 of Inside Retail discussed Australian Franchises, the changing economics of the retail landscape (impact of online shopping, big box retailing and flat wages growth) and the inability of many franchisors to “innovate or adapt their business models to meet the more challenging retail market conditions”. While the community pharmacy franchise landscape is less exposed to pressures or risks to general retail, some pharmacy profits are reducing which will inevitably increase tension and the industry’s “weakest link” is arguably shopping centre pharmacies where strong franchise relationships are most important.

For all franchises to survive and indeed thrive it is essential that the relationships between franchisee, franchisor and landlord are symbiotic – ie each understands how their own needs are aligned with the others such that each party’s position is optimised without negatively impacting the others. In simple terms, relationships are put at risk if the franchisee ends up paying more to the landlord and/or franchisor than is left over for themselves - or profit is reducing or has simply ceased to exist. This has happened for many retail franchisees across Australia in recent years (hence the Inside Retail article) and it is important that these learnings are not overlooked within the Pharmacy sector.

When considering weak links (and consistent with the general retail sector), shopping centre owners value national brands and often dictate their preferences which ultimately result in high rental rates (usually rising annually at above inflation rates) often applied to space allocations which are excessive to requirements.

The effect for the shopping centre pharmacy sector in recent years has been decreasing profits and therefore increasing bank loan default risk. So while shopping centre pharmacies represent a small proportion of the total pharmacy population their potential impact on the risk margin applied by banks to lending rates for the sector could be significant in the event of default.

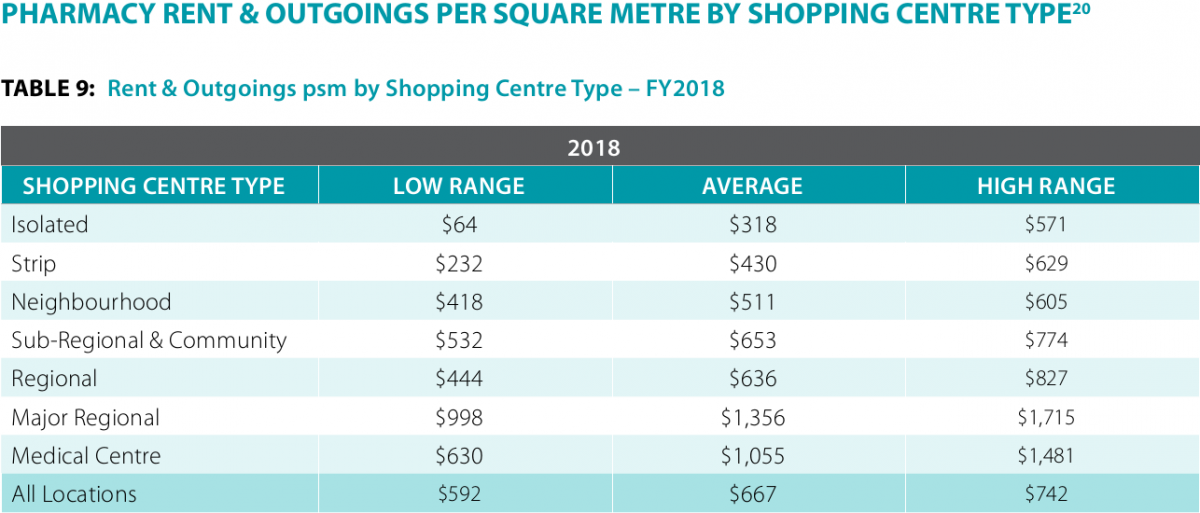

The attached table is an extract from The Pharmacy Guild of Australia’s “2019 Pharmacy Rental Report” which shows that Major Regional shopping centre pharmacies are paying on average more than double the square metre rate of all other pharmacies (excluding medical centre businesses which typically occupy less than 100 sqm). Moreover pharmacies in major regional centres will also typically occupy more space (300sqm – 600sqm).

In a previous PP blog article (Rents – space, rent, negotiate 14/1/19) we discussed a sustainable profit target for shopping centre pharmacies of over $20k per sqm. Historically this has been difficult to achieve as shopping centre pharmacies space and rate have often arisen through a tender proposal arrangement often facilitated by the franchisor. Location rules have also often skewed the process in favour of shopping centre owners as shopping centres are entitled to one pharmacy if they have over 15 retail tenancies (including a supermarket), two pharmacies if they have over 100 retail tenancies or three pharmacies if over 200 retail tenancies. This entitlement is enacted by the Government providing a “free” licence to a Pharmacist who has agreed to a lease with the landlord inside the relevant shopping centre.

If shopping centre pharmacy profits continue to decrease for the aforementioned reasons, business risk will continue to rise for owners, franchisors, landlords, banks and non-shopping centre pharmacies with debt who will inevitably suffer from the weakest link knock-on effect in the event of a default.

In our view circuit breakers need to be identified and enacted. These are actions that will assist to increase the negotiating power of pharmacy owners to optimise their space to guarantee long term profitability for themselves and their franchisors. Shopping centre owners also benefit over the long term due to enhanced tenant stability despite a likely reduction in space and gross rent.

One opportunity is to simplify the rules for entitlement to “free numbers” in shopping centres. For example, eliminating the 3rd free number at 200 stores and increasing the eligibility for a 2nd free number from the 100 store threshold to 150 would provide owners a more balanced negotiating environment without impacting consumers or limiting pharmacies within a 1.5km radius of shopping centres to relocate inside.

An improved legislative framework to strengthen franchisor and franchisee outcomes however does not eliminate the need for both owners and franchisors to develop their offer to maximise relevance to consumers in a complex and changing retail environment. Smaller stores (ie space optimised so that stores can generate at least $20k turnover per sqm) with focussed health offers incorporating seamlessly integrated delivering healthy margins for all is a formula that will strengthen all links of the pharmacy chain while maximising consumer outcomes.